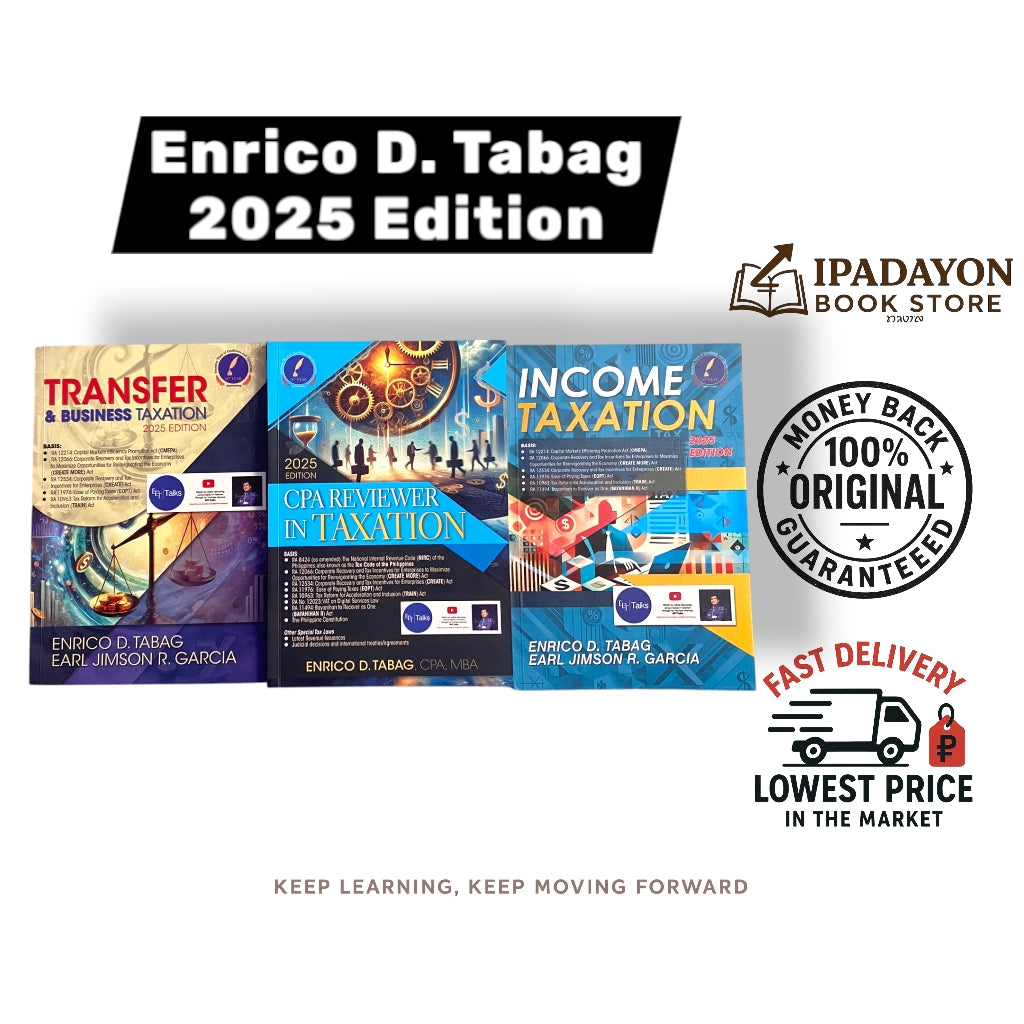

CPA Reviewer in Taxation 2025 Edition by Enrico D. Tabag, CPA, MBA

CPA Reviewer in Taxation 2025 Edition by Enrico D. Tabag, CPA, MBA

Couldn't load pickup availability

Stay ahead in your CPA journey with the latest 2025 Edition of the CPA Reviewer in Taxation. Authored by Enrico D. Tabag, CPA, MBA, this trusted reviewer is designed to help accountancy students, CPA board exam takers, and practitioners strengthen their knowledge and mastery of Philippine taxation.

🔑 Key Features:

Covers RA 8424 (NIRC of 1997, as amended) and its latest updates

Includes tax laws under CREATE Act, TRAIN Law, and other recent issuances

Updated with judicial decisions, revenue regulations, and international treaties/agreements

Comprehensive discussions and simplified explanations for better retention

Designed for CPA reviewees, accounting students, and tax professionals

📝 Basis of Coverage:

CREATE (Corporate Recovery and Tax Incentives for Enterprises Act)

TRAIN (Tax Reform for Acceleration and Inclusion Act)

CREATE MORE (CREATE to Maximize Opportunities for Reinvigorating the Economy Act)

GDP (Gross of Policy Sources)

Digital Services Tax provisions

Latest Revenue Issuances & BIR Circulars

Relevant provisions of the Philippine Constitution

📦 Why Choose This Reviewer?

✔ 100% Original Copy – Guaranteed authentic

✔ Clear, concise, and exam-focused

✔ Trusted by thousands of CPA reviewees nationwide

✔ Backed by years of expertise in taxation and CPA education

Perfect for:

CPA Board Exam Reviewees

Accountancy Students

Accounting and Finance Professionals

Tax Practitioners

👉 Keep learning, keep moving forward with the CPA Reviewer in Taxation 2025 Edition!

Share